Hiring the right people is essential for your business. You want someone who’s a perfect fit, but there’s always the risk of overlooking something critical in their background.

A 2022 study found that 74% of companies have caught a lie on a candidate’s resume through background screening. This high incidence highlights the necessity of conducting comprehensive background checks to safeguard your business and hire the most qualified candidates.

However, many organizations don’t realize that improper use of these checks can lead to serious legal trouble, especially when employers fail to ensure Fair Credit Reporting Act compliance. According to a recent study, over 5,587 FCRA-related lawsuits were filed against employers in 2023 alone.

The Fair Credit Reporting Act (FCRA) sets clear rules for employers’ use of background checks. Following these rules protects your business from legal risks and ensures a fair hiring process for everyone.

The Fair Credit Reporting Act (FCRA) is a federal law enacted in 1970 to promote accuracy, fairness, and privacy in the use of consumer information. It primarily governs how consumer reports, such as credit, criminal, and background checks, are used by employers and other entities.

As an employer, you must understand the Fair Credit Reporting Act (FCRA), which establishes the foundation for effective and FCRA-compliant background check practices.

FCRA Compliance: Who Must Comply and Important Employer Responsibilities

The Fair Credit Reporting Act (FCRA) applies to any employer that uses third-party consumer reports to make hiring, promotion, or retention decisions. This includes credit history, criminal background checks, employment verification, driving records, and education verification. If you’re using these reports for any employment-related decision, FCRA compliance is mandatory.

An employer must follow FCRA guidelines to ensure fair hiring practices and avoid potential legal risks.

Written Consent

Before conducting a background check, you must obtain the candidate’s or employee’s written permission. This consent must be explicitly given and not bundled with other documents, such as job applications.

Disclosure

You must provide a standalone disclosure informing the candidate that their consumer report will be used in the hiring process.

Pre-Adverse Action Process

If the report contains information that may lead to an unfavorable decision (such as not hiring or promoting the candidate), you must first:

Provide the candidate with a copy of the report.

Include a summary of their rights under the FCRA, allowing the candidate time to dispute any inaccuracies.

Final Adverse Action Notice

After the pre-adverse action process, if the decision remains negative, provide a final notice with the CRA’s contact details, a statement that the CRA didn’t make the decision, and instructions on how to dispute the report’s accuracy.

These responsibilities ensure compliance and foster transparency and fairness throughout the hiring process.

Understanding the “Seven-Year Rule”

The FCRA’s “Seven-Year Rule” limits the length of time certain types of information can be reported on a background check. This rule applies primarily to negative information, such as bankruptcies and civil judgments, which can generally only be reported for up to seven years.

Criminal Convictions

The FCRA’s “seven-year rule” does not apply to criminal convictions.

Criminal convictions can remain on a background check indefinitely in states without specific restrictions.

Exceptions to the Rule

For roles with annual salaries exceeding $75,000, bankruptcies older than seven years can still be reported.

Civil suits, liens, and judgments must be removed after seven years. However, some states may allow them to remain longer based on local laws.

State vs. Federal Law

The FCRA sets the federal baseline for background checks across the country. While the FCRA provides a general framework, states can impose stricter rules on how far back certain criminal records can be reported or what types of information can be included.

Employers should regularly review federal and state regulations to ensure employees comply with all applicable laws.

Investigative Consumer Reports differ significantly from standard consumer reports. These reports involve personal interviews with a candidate’s acquaintances, such as neighbors or colleagues, and require stricter adherence to FCRA guidelines. Employers must provide candidates with a specific disclosure detailing the scope and nature of the investigation and inform them of their right to request further details. Unlike standard reports, which focus on factual data like credit history or criminal records, investigative reports delve into personal insights, making meticulous compliance with disclosure and notice procedures critical to avoid severe legal penalties.

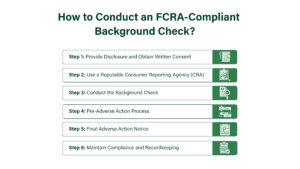

How to Conduct an FCRA-Compliant Background Check?

To avoid penalties, ensure your background checks are FCRA-compliant by following specific legal steps:

Step 1: Provide Disclosure and Obtain Written Consent

Before you begin any background check, you must disclose to the candidate that a consumer report will be used in the hiring process. The candidate must then give written consent to the background check. The disclosure and authorization must not be part of the job application or bundled with other documents.

Step 2: Use a Reputable Consumer Reporting Agency (CRA)

Partner with a CRA that understands FCRA regulations and adheres to them. The CRA must provide accurate and up-to-date information. It’s essential to select an agency with a solid dispute resolution process.

Step 3: Conduct the Background Check

Once you have obtained consent from the candidate, you can proceed with the background check. It is crucial to ensure that the report contains only legally permissible information and strictly follows federal and state-specific regulations.

Additionally, verify that the report adheres to the FCRA’s time limits for reporting certain types of information, like bankruptcies or tax liens, which must comply with the seven-year rule unless otherwise exempted (such as for higher-salary roles).

Step 4: Pre-Adverse Action Process

If the background report contains information that might lead you to make a negative decision (such as deciding not to hire the candidate), you must take these steps:

- Provide the candidate with a copy of the background report.

- Include a summary of their rights under the FCRA, which informs them of their ability to dispute inaccurate or outdated information.

- Allow the candidate time to respond and correct any inaccuracies in the report before making a final decision.

Step 5: Final Adverse Action Notice

Send a final adverse action notice if you decide to proceed with the negative decision after the pre-adverse action process. This notice must include:

- The name and contact details of the CRA that provided the report.

- A statement that the CRA did not make the hiring decision and cannot provide specific reasons for the adverse action.

- Information about how the candidate can dispute the report’s accuracy.

Step 6: Maintain Compliance and Recordkeeping

After completing the background check process, store records securely and comply with applicable data privacy laws. Keep detailed records of your FCRA compliance process, including disclosure forms, consent records, and any communication with the candidate regarding disputes or corrections.

The Consequences of FCRA Violations and How to Avoid Them

FCRA Violations: Understanding the Penalties for Non-Compliance

Non-compliance with the Fair Credit Reporting Act (FCRA) can lead to significant legal and financial consequences for employers. These penalties can vary depending on the severity of the violation. Still, they often involve statutory and actual damages, attorney fees, and punitive damages in cases of willful or repeated violations.

Here’s a breakdown of the potential penalties for FCRA violations:

Statutory Damages

Entities found violating the FCRA may incur fines ranging between $100 and $1,000 for each instance of non-compliance.

Actual Damages

Suppose the violation results in tangible harm, such as lost wages or damage to reputation. In that case, the entity may be liable for compensating the damages incurred by the affected parties.

Attorney Fees and Legal Costs

In cases where a violation leads to legal action, the offending party may be required to cover the complainant’s attorney fees and associated legal expenses.

Punitive Damages

Willful or repeated non-compliance may attract punitive damages intended to deter future violations.

Class Action Lawsuits

FCRA violations can lead to class action lawsuits, where multiple affected individuals may join together, significantly increasing the financial impact through legal fees and potential settlements.

Preventing FCRA Violations: Best Practices to Follow for Employers

Employers must understand common pitfalls and implement effective preventative measures to mitigate costly penalties associated with non-compliance with the Fair Credit Reporting Act (FCRA). Below are some frequent FCRA compliance issues and best practices to avoid them:

Misuse of Consumer Reports

Employers often mistakenly use background reports for purposes beyond hiring, such as assessing current employees for promotions without obtaining the necessary consent.

Ensure that every use of a consumer report, be it for hiring, promotions, or retention, is backed by explicit, written consent from the individual concerned. Training HR staff to recognize the boundaries of permissible use is essential.

Failure to Provide Adequate Disclosure

A prevalent issue arises when employers fail to clearly and separately disclose the use of consumer reports, often embedding such disclosures within job applications.

Always provide a distinct document outlining the intent to conduct a background check. This document should be straightforward, easily understandable, and contain no extraneous information.

Automated Background Check Systems

While automated systems can speed up the process, they can also lead to inaccuracies or outdated information being reported if not carefully monitored.

Conduct regular audits of your automated systems to maintain accuracy. Scrutinize reports to identify and correct any inaccuracies or outdated information before making employment decisions.

Outsourcing Background Checks without Proper Oversight

Outsourcing background checks to third-party agencies does not absolve the employer of their responsibility to ensure compliance with FCRA regulations.

Partner with reputable Consumer Reporting Agencies (CRAs) that understand and adhere to FCRA regulations. Regularly audit their processes to ensure compliance.

Continuous Monitoring: Ensuring Compliance Beyond Hiring

In specific industries, background checks don’t end at the hiring stage. Ongoing or continuous background monitoring is required to ensure that employees comply with industry regulations or the employer’s needs. However, this adds another layer of complexity to FCRA compliance.

Industries Requiring Continuous Monitoring

- Education: Regular screenings are conducted for school staff to maintain a clean criminal history.

- Healthcare: Continuous monitoring of medical professionals is crucial for up-to-date licensing and background information.

- Financial Services: There is a need to consistently ensure compliance with regulations related to fraud and financial crimes.

- Law Enforcement: Frequent checks are required for compliance with legal and ethical standards.

Challenges in Continuous Monitoring

- Ongoing Consent: One main challenge is ensuring continuous consent from employees for background checks. This is essential to complying with FCRA regulations while respecting employee privacy.

- Adverse Action Protocol: If negative information is discovered during monitoring, employers must carefully follow the FCRA’s detailed procedures for pre-adverse and adverse actions. This ensures that all legal standards are met without causing unnecessary harm.

- State and Local Laws: Employers also face the challenge of keeping up with different state and local laws, which can vary widely in terms of what’s allowed for background checks. Staying informed and compliant with these laws is crucial to avoid legal issues.

Ensuring FCRA Compliance: Tips for Employers

Compliance with the Fair Credit Reporting Act (FCRA) is essential for employers to mitigate legal risks and protect their business. Here are some tips to help you stay on the right side of the law:

Work with Reputable Screening Companies

Partnering with a third-party screening vendor that adheres to FCRA regulations is crucial. Not all screening companies follow the same standards, and choosing a disreputable provider can expose your organization to risks. Verify that the screening company conducts thorough checks and is recognized for its accuracy and compliance. Agencies accredited by the National Association of Professional Background Screeners (NAPBS) demonstrate a commitment to high screening standards.

Regularly Update Compliance Practices

The legal market is constantly evolving, and what was compliant yesterday might not be compliant tomorrow. It’s essential to regularly review and update your compliance protocols to reflect any changes in the law or best practices.

Schedule annual reviews of your FCRA compliance policies and procedures and monitor any new legislation impacting your hiring practices.

Train HR Staff

Your human resources team plays a vital role in ensuring FCRA compliance. Regular training on FCRA obligations is essential for empowering your staff to follow the correct procedures when handling background checks.

Conduct workshops or seminars that cover FCRA requirements, the adverse action process, and the importance of documentation. Consider using real-world scenarios to help staff understand the implications of non-compliance.

Conduct Internal Audits

Periodic internal audits of your hiring processes can help you identify areas where compliance may be lacking. These audits can provide valuable insights into your current practices and highlight gaps that need addressing.

Create an audit schedule, quarterly or biannually, to review consent forms, background check reports, and documentation for adverse actions. This proactive approach will help ensure that your organization maintains compliance with FCRA regulations and can quickly correct any identified issues.

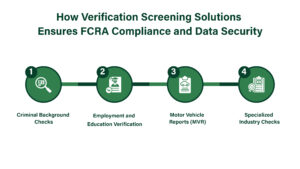

How Verification Screening Solutions Ensures FCRA Compliance and Data Security

Verification Screening Solutions enhances your hiring process through a comprehensive suite of background checks and verification services that are FCRA compliant and prioritize data security.

Criminal Background Checks

Our extensive county, statewide, and federal searches allow you to thoroughly vet candidates for serious offenses, including fraud and violent crimes. With our nationwide services, you receive all the essential information required, regardless of a candidate’s previous residence, ensuring a robust screening process.

Employment and Education Verification

We verify employment history and educational credentials to confirm that candidates possess the qualifications they claim. This reduces the risk of hiring unqualified or dishonest individuals and enhances the integrity of your workforce.

Motor Vehicle Reports (MVR)

For positions that involve driving, our MVR checks provide detailed histories of traffic violations, DUIs, and accidents. This information is crucial in hiring responsible drivers and minimizing your organization’s liability.

Specialized Industry Checks

We offer tailored screening services for various industries, including healthcare, finance, IT, and government. Our checks include sex offender and federal civil searches, meeting these sectors’ specific compliance and security requirements.

FCRA Compliance and Data Security: All our searches comply with the Fair Credit Reporting Act (FCRA), ensuring legal compliance and protecting candidate privacy. Employers can confidently trust their screening results with no hidden fees and secure data handling.

Ensure Safety and Compliance in Every Hire with Verification Screening Solutions

At Verification Screening Solutions, we specialize in providing reliable, FCRA-compliant background screening services to help you make informed and confident hiring decisions. Our comprehensive solutions cover criminal background checks, employment and education verification, motor vehicle reports, and industry-specific searches—ensuring you stay compliant with all applicable regulations.

Don’t risk costly violations! Let us help you navigate the complexities of background screening with confidence.

Get in touch today to learn how we can support your hiring process and safeguard your business from compliance pitfalls.